Every year Social Market Analytics (SMA) is proud to work with the University of Illinois Masters of Science in Financial Engineering Students on a practicum project. In the past we have explored looking at sentiment to predict the VIX, enhancements to traditional indexes and smart beta ETF's. This year we decided to tackle the most popular topic of the last year - Bitcoin Trading! We worked with RCM Capital's Strategy Studio Platform for back testing to develop a Bitcoin trading strategy combining price momentum with sentiment to keep you in the market when Bitcoin is trading up and minimizing draw downs when Bitcoin retreats as it did in early 2018.

Social Market Analytics tracks sentiment on the top 275 market cap currencies, the below Bitcoin strategy performs similarly on other Crypto currencies.

The students did a wonderful job in strategy construction and explanation. I will undoubtedly leave something important out. ContactUs@SocialMarketAnalytics.com for details.

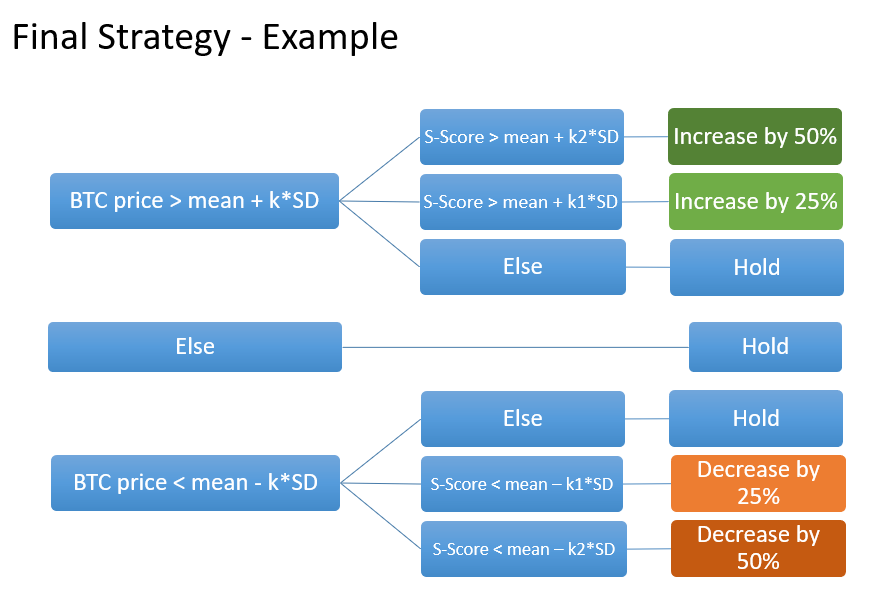

At it's core the strategy buys on a price breakout with a sentiment confirmation. Exit when price breaks down and is confirmed with sentiment. Buy when the price crosses above (K) standard deviations over a 21 day moving average of price. Variable K ranged from .5 to 2. Results shown use a .5 standard deviation multiplier. Strategy visualization is below.

Your first trigger is a breakout above K- Standard deviations of the 21 day moving average.

The confirming signal is based on the Social Market analytics S-Score value. S-Score is a normalized representation of Bitcoin's Sentiment time series over a look back period and is updated every minute. It measures the tone of the conversation on Twitter relative to the benchmark time period. If Bitcoin is breaking out and the sentiment is 2 standard deviations more positive than normal you initiate or add to your position by 50%. If the conversation is 1 standard deviation more positive than normal increase the position 25%. If the standard deviation price break out is not confirmed by sentiment then no position change.

There was no short position initiated with futures. Exit criteria are opposite entry criteria. Price break below K - Standard deviations below a moving average. Confirmation with S-Score.

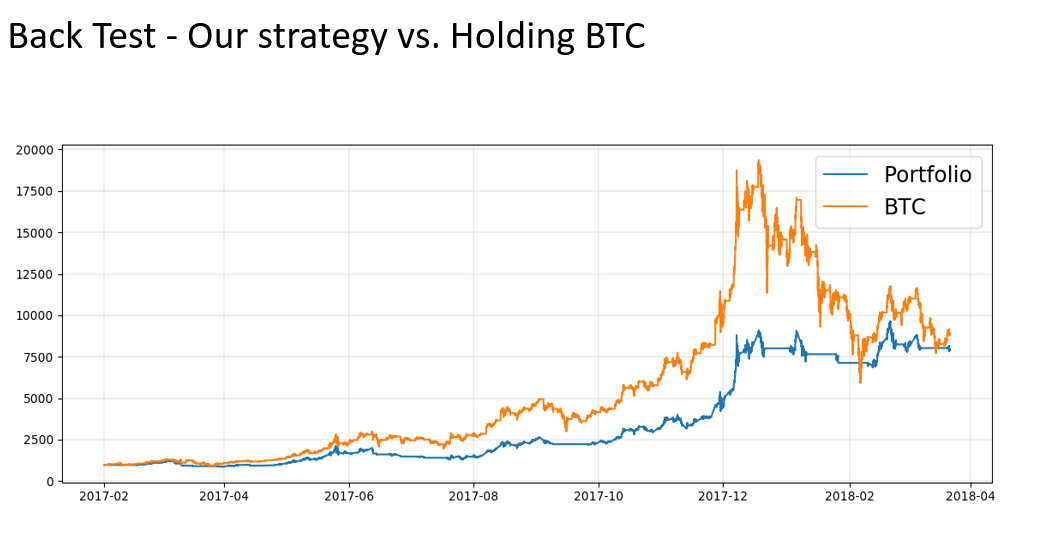

Dollar P/L results indicated this portfolio successfully navigates the the bitcoin draw down of early 2018. 2018 in isolation is below.

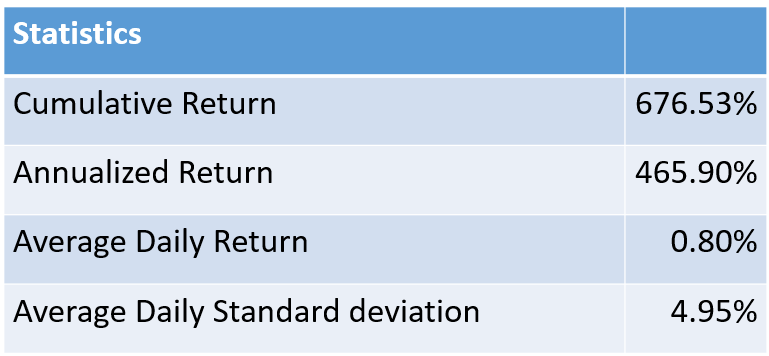

Overall performance with Buy & Hold Bitcoin comparison.

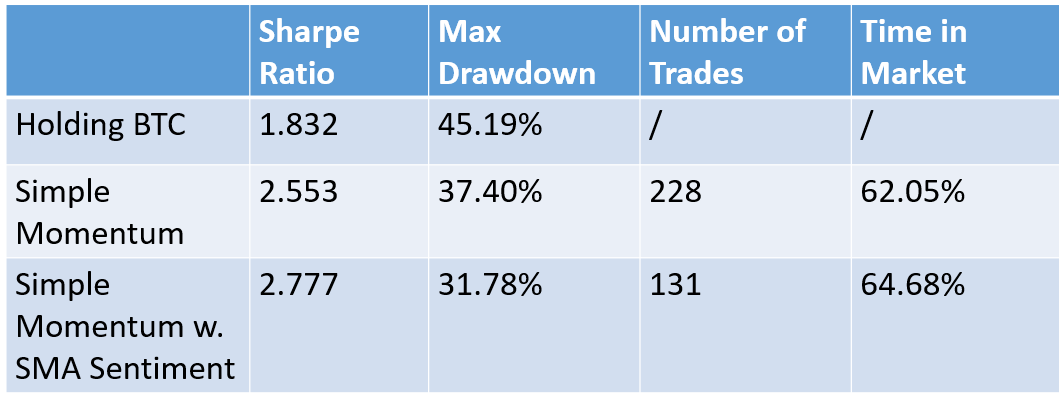

Sharpe ratio and draw down improve dramatically with the momentum and sentiment confirmation.

Again, please ContactUs@SocialMarketAnalytics.com for more information on our offerings.

Thanks again to the University of Illinois MSFE students and RCM Capital Markets for contributing to this project.

Regards,

Joe